Representatives of local non-profits, agencies, and churches joined Monday to explore new ways to help the community’s disadvantaged, disenfranchised, and currently disconnected – and, perhaps more importantly, help them help themselves.

And while one local minister at Home Sweet Home’s (HSH) Forging A Better Way meeting on Bloomington’s east side emphasized “there isn’t a single person here who’s being ‘served,’” he and others agreed those who need essential services and assistance should play an expanded role in determining how local charities structure and administer them.

"The Forging a Better Way task force has outlined the goal of restoring a sense of dignity, worth, and personal capacity to our charitable systems,” concluded participant Luella Mahannah, counseling director of Integrity Counseling, on Bloomington’s west side. “At the meeting tonight, it became clear that we must include the ‘consumers’ of charitable services in developing and delivery of such systems. To not engage those in need will lead to continuing to develop mechanisms that could likely be enabling rather than empowering."

Working off major focus areas identified recently by an HSH steering committee, the group explored issues including:

* Money/Income-related interests (debt reduction/asset building, loan alternatives, fiscal fitness, employment opportunities, etc.). A major focus of the group Monday was the importance of developing low-income finance alternatives to local “payday loan” services that according to New Covenant Community church Social Justice Group representative Pam Lubeck too often “jack up” weekly fees, exacerbating already burdensome debt. That “snowball effect” impacts the financial stability of many families dependent on payday lenders, HSH’s Matt Burgess stressed.

Mid-Illini Credit Union, which operates a branch at Bloomington’s Mt. Pisgah Baptist Church, offers low-volume loans free of fees to neighborhood residents, while Next Step, a partnership between Mid Central Community Action, United Way of McLean County, Heartland Community College, and the University of Illinois College of Law provides free services to help individuals and families gain financial independence. HSH’s Faith and Finance classes help the mission’s displaced and disadvantaged clients learn about budgeting, spending, and future saving – Burgess reported eight to nine individuals recently completed a recent class conducted at Bloomington’s The Hub.

Monday’s participants also were enthusiastic about the possibility of “microloan” programs similar to international financing options that can help launch promising but income-strapped enterprises. Such programs have spurred development of small-scale, grassroots local businesses in Africa, Asia, and South America, and participants suggested they could be used as an “incubator” for cooperative neighborhood economic development.

“When you invest in micro-credit, you get your money back,” Lubeck noted.

She and others agreed financial education and awareness should begin early, so teens receiving their first paycheck can start from a position of security. Afterschool programs and school-based curricula and extracurricular activities could help offer that education.

* Health concerns (both physical and mental health, as well as issues relating to substance abuse recovery). Even as new health care law rolls out slowly to improve options for low-income Americans, a number of key issues face disadvantaged communities, including coordination of services, basic transportation to and from health care providers and resources, state funding cuts that endanger preventive programs that help reduce future health care costs, and the impact of mental health issues on employment, housing, and law enforcement/incarceration.

Especially challenging are the issues of health care access – first-time and low-income mothers-to-be currently must travel to Peoria for prenatal services and counseling – and cost – health insurance premiums remain high, and as one participant said, even out-of-pocket deductibles that lower premium costs “clobber” low-income families.

HSH is helping address the needs of essentially landlocked west side residents through its mobile health unit that travels the community twice a month, with two exam rooms. The McLean County Board of Health’s Cory Tello notes that each month, doctors visit Normal’s Fairview School – the area’s currently sole “community school” that serves as a hub for supplemental medical and other area services. She maintained additional community schools could help multiply health options for the Twin Cities.

Fundamentally, Bloomington-Normal’s underserved communities need “a full continuum of services, from pre-birth to senior care,” Tello maintained. Community colleges and area universities could play a role in expanding low-cost or non-profit services while training future providers.

* “Neighboring” concerns – how to be a good neighbor within the community. Local churches, organizations such as HSH the Boys and Girls Clubs, and schools already cooperate in providing outreach and support for disadvantaged youth and others throughout the community, but Monday’s participants saw the need to developing new mentoring relationships, referral options for providing ride assistance for low-income or physically challenged residents, and art programs that could inspire and “empower” young people.

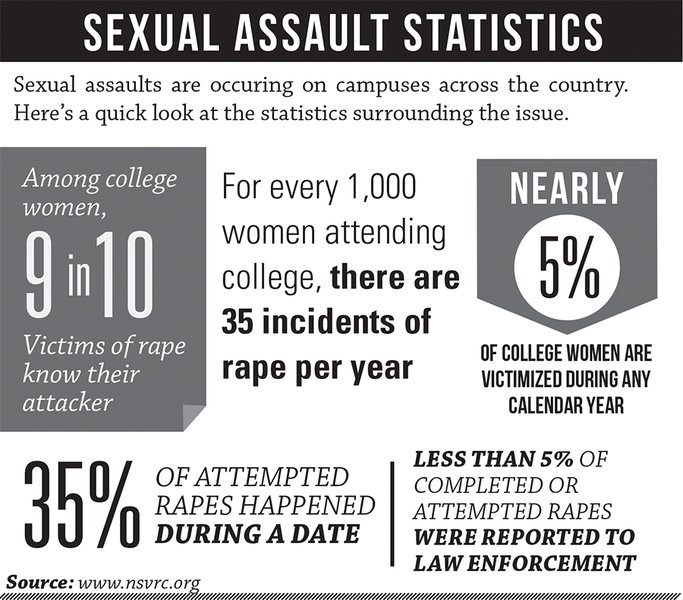

Bloomington’s John M. Scott Health Resource Center handles transit where needed for maternal and child visits; Faith in Action is an interfaith network of volunteers, churches, and community organizations that assist individuals over 60 and their caregivers. The McLean County YWCA’s Stepping Stones program counsels victims of sexual assault, and Integrity Counseling and Heart to Heart offer mental health services at rates low-income clients can afford.

But costs again are a key factor in expanding or even maintaining existing services. John Scott lost its vision program in December, and there currently are no convenient transportation options for Medicaid patients who must travel to Peoria for oral surgery.